Staking Rewards

Staking Rewards are received by participants of the respective blockchain, as an incentive for validating a block of transactions. By staking crypto, you choose to validate transactions on the blockchain, allowing for a quicker and safer network, this in turn allows you to receive a portion of tokens back from fees or a pool as Staking Rewards.

If this sounds confusing to you, let’s break down what Proof of Stake is, the mechanism behind the rewards you receive into your wallet.

What is Proof of Stake?

There are several mechanisms that power and progress the cryptocurrencies we know of. A consensus mechanism is a way for a blockchain to validate transactions within the network. From Bitcoins Proof of Work (PoW) to VeChains Proof of Authority (PoA) mechanism, there are an abundance of consensus mechanisms that keep the systems we know running. Arguably the most cost-effective mechanism is the Proof of Stake (PoS) mechanism.

PoS is a consensus mechanism that uses crypto tokens a participant holds to validate transactions, as oppose to using expensive computers to physically validate transactions, like Bitcoin does.

To understand what PoS is and how it works, it may be better to understand Proof of Work first.

Scenarios

Imagine there is a race track, the participants of the race line up at the start. Every participant is different – old, young, tall and small. There are men, women and children. Some are overweight and some are underweight. It’s already clear that the chances here are far unequal. There is only 1 prize for winning the race, 1st Prize (no 2nd or 3rd) and the prize is a big sum of BTC. The race whistle blows and everyone starts running. The person with the best shape, fitness or overall conditioning is more than likely going to win.

Now imagine there are consecutive races, one after another. It’s quite obvious to see that the same person (save for an injury) is going to win every time. This is how you describe Proof of Work. The participant with the best equipment will be the one to validate the node each time. Although – there is a small amount of luck with PoW, this means that everyone does have a slight chance to win the race. In short, the better computers you have and the more computers you have make you more likely to win that mineable block.

Now imagine the same scenario, but this time only one participant is chosen to race, meaning they are guaranteed to win that block. To participate in this race, you need to put up a sum of money, otherwise known as a stake. These funds are seen as collateral to make sure you don’t do anything fraudulent or do any bad things to the node.

How does a participant get picked? Each model is different, but in general it depends on the amount staked, the amount of time staked and some random algorithm to make it fairer for everyone. This is PoS.

Receiving Staking Rewards

Once the staking consensus mechanism is understood, understanding how a participant receives staking rewards is a lot easier. Most exchanges offer staking or yield options on certain tokens. This is known as delegation. There are some barriers to entry for becoming a node validator, for instance, to validate an Ethereum Node independently, you would need to own and stake 32 ETH. To overcome these obstacles, several exchanges or platforms will offer delegation services in which they would become a Validator and their end users have the ability to stake a small number of tokens for a specified APY return. These returns are a lot smaller than what you would earn if you were validating a node, but there are less risks to being a delegator too. It is worth shopping around as different exchanges such as Binance, Nexo or Swissborg will offer different returns.

Each exchange & platform have their benefits and drawbacks, so it is up to you to decide which best suits your specific needs and tolerance. It is important to note that some staking rewards are not sustainable long term, and the rewards you earn is dependent on the number of validators & delegators, and the amount of the respective token in the staking pool. Take that into consideration when choosing long term staking protocols to invest in. Just recently Crypto.com slashed their rates by a significant amount which led to a lot of people exiting the protocol and thus pushing the price further down leading to even less rewards.

Stakingrewards.com has a great tool to calculate the estimated staking rewards for a variety of tokens. APY depends on the type of stake and staking provider used.

Staking Rewards and the tax implications

Staking rewards are usually taxable as income (miscellaneous income) at the time of receipt. You may also have to pay Capital Gains Tax when you dispose of the asset at a later date. This will depend on whether the asset has increased or decreased in value since acquired. Should the asset decrease in value, you may be able to claim a capital loss.

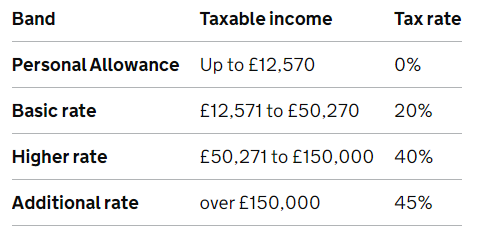

Below are the HMRC UK (excl. Scotland) tax tables for the 2021/22 and 2022/23 income tax rates and bands. The table provides the tax rates for each band if you have a standard Personal Allowance of £12,570.

Example

Example

- You earn £42,000 a year in your employment, at an income tax rate of 20%

- You begin staking and receive £30 a day in staking rewards.

- Over the course of a year, you earned £10,950

- Part of this staking income would be subject to a tax rate of 40%

Assistance

This article does not cover everything you need to be aware of. Tax can be complex, so it is always advisable to seek professional tax advice when completing your tax return. If you require any further information or assistance with making the necessary declarations and/or calculations, please contact us. A member of our team will be happy to help.