This article will go through some of the things to consider with Restricted Securities, also known as Restricted Share Units or Restricted Stock Units – RSUs.

What are Restricted Share Units – RSUs?

RSUs are shares that are awarded to an employee, whom will receive these upon meeting the restriction conditions. They therefore form part of your remuneration package and are generally awarded from large listed businesses such as Facebook, Twitter, Google, BT, Morgan Stanley, Amazon, and Salesforce but other business like Fosters + Partners and smaller businesses do also offer them.

These can form a significant part of your over-income package and wealth. It is therefore important to understand how RSUs work and are taxed.

What Restrictions may you have on your RSUs?

There are 2 main type of restrictions:

- Subject to forfeiture – where the shares revert back to the company when a certain event occurs. The most common being where an employee leaves the company within a certain period.

- Subject to restrictions relating to when or whom they may be sold. This means the employee is allowed to keep the shares, but they may not sell the share or can only sell them to certain people with a certain period.

We most commonly see them subjected to forfeiture and, depending on the nature of the restriction, this can affect the tax charge.

Why are RSUs awarded to Employees?

There are several reasons why RSUs are awarded to employees.

- It can incentivise an employee to stay with the company, as otherwise they may lose them.

- It can incentivise an employee to help drive the company to grow, as any they will stand to benefit from any increase in share price.

- From a company perspective, issuing shares is cheaper than awarding extra pay via cash, and some opt to make the employee pay the Employer’s National Insurance.

How are RSUs awarded and vested?

An employer will decide how to award the Restricted Share Units and the terms that they vest under. In terms of vesting, the qualifying period can happen in a number of ways:

- All vest when the period ends e.g. the qualifying period is 3 years.

- Vest annually over the qualifying period.

- They may vest bi-annually over the qualifying period.

- Quarterly over the qualifying period.

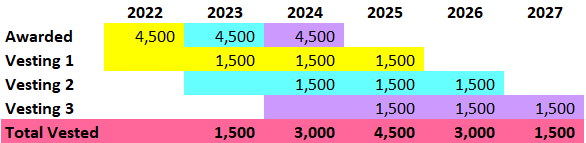

In the example below, we have assumed an employee is awarded 4,500 shares over 3 years. These shares then vest 33.33% each year, which is equivalent to 1,500 shares.

In this example if you discontinued your employment from 2025 onwards and still received RSUs, you can see every year you could potentially lose 4,500 worth of shares, as 1,500 would be in the process of vesting each year.

This effectively creates a cliff edge for the vesting, which can encourage an employee to stay in employment, as once they have been there for 3 years they stand to lose 4,500 worth of shares (assuming more shares are awarded in 2025 onwards).

How are RSUs taxed in the UK (Simplified)?

This is a complex area, , there is not a specific RSU tax calculator for the UK. It would be too hard to create a ‘one-size-fits-all’ RSU tax calculator as there are different factors that need to be considered. We will explain these and detail how RSUs are taxed below.

The most common type of restriction is those subject to forfeiture within 5 years and our example below covers this type of RSU.

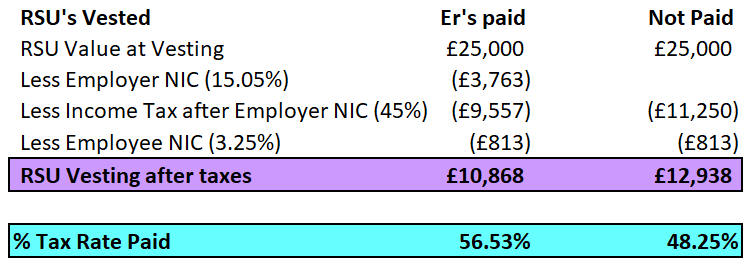

Below you can see the tax a 45% taxpayer may face in the 22/23 tax year if they have to pay the Employer’s National Insurance and if they did not, as whether or not they have to pay this is at the discretion of their employer. The tax amount changes depending who pays the Employer’s National Insurance, but this does not apply to employee National Insurance Contributions (NIC).

What usually happens is that in order to pay the tax, the equivalent shareholding is sold, and then the residual (net) balance remains for you to either sell or retain. In the above example if 100 shares were awarded, 57 or 49 may be sold to cover the taxes, leaving either 43 or 51 respectively.

RSU Tax UK (In more detail)

This is a complex area. The most common type of restriction is those subject to forfeiture within 5 years and our example below covers this type of RSU.

Those subject to forfeiture

At the share award date, the shares have a depressed value due to the restrictions placed on them. The tax charge will depend on whether the shares are subject to forfeiture either:

- Within 5 years – no income tax charge on the date of issue/award but there is a tax charge on the percentage value of the shares awarded when the restrictions are lifted.

- After 5 years – there is an income tax charge on the date of issue/award at the restricted value, and a further income tax charge based on the percentage value of the shares awarded when the restrictions are lifted.

Those subject to disposal restrictions

At the date the shares are awarded to an employee, the shares have a depressed value due to the restrictions placed on them. There will be a tax charge on the date of issue/award at the restricted value and a further income tax charge based on the percentage value of the shares awarded when the restrictions are lifted.

How to calculate the percentage value?

The percentage is the initial unrestricted market value of the shares that were neither taxed nor paid for when the shares were acquired.

For example:

An employee is awarded 5,000 shares in the company in January 2019 they work for when the share are valued at 300 pence (£3), that the employees does not need to make a payment for but if the employee leaves before the vesting date in January 2022 (are subject to forfeiture) he will lose the entitlement to these. In January 2022 the shares were worth 500 pence (£5).

As these are subject to forfeiture within 5 there is no tax charge in respect of the initial award. This also means the percentage tax charged on acquisition is £nil.

When the shares vest in January 2022 the amount on which tax is charged on is 5,000 @ £5 * 100% = £25,000.

Please note if readily convertible to cash e.g. a market exist to sell, National Insurance will be due.

Once these shares vest the employee is treated as having acquired 5,000 shares for £25,000. Any further increase or decrease in value are then subject to Capital Gains Tax.

Two types of Elections explained

There are two elections available which changes the charge to taxation. In order to alter this basis the elections must be:

- Jointly made between the employer and employee;

- Made within 14 days of the award and

- There is no opportunity to change your mind (irrevocable).

The election paperwork must be signed and kept on file by the company if HMRC were to query it. There is no obligation to send the election when made.

Election under s.425(3)

This only applies to shares that are subject to forfeiture within 5 years of the award. Here an exemption can be made to apply a tax charge on the initial award. This effectively treats the shares in the same way as if they were subject to the restrictions after 5 years.

If the employee leaves within the forfeiture period or are sold for less than the restricted market value then this is no possibility of recovering the tax paid on the initial award.

An example

An employee is awarded 5,000 shares in the company they work for in January 2019, when the share are valued at 300 pence (£3). The initial unrestricted market value is therefore equivalent to £15,000. The employee does not need to make a payment for the shares, but if the employee leaves before the vesting date in January 2022 (shares are subject to forfeiture) he will lose the entitlement to them. HMRC have agreed with the employer that the shares have an unrestricted market value of 60 pence (£0.60).

In January 2022 the shares were worth 500 pence (£5).

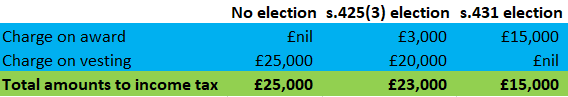

As we have seen above with no election being made the taxable amount on the vesting would be £25,000 (5,000 x £5).

If an election had been made the employee would have paid tax on the restricted value in January 2019: 5,000 @ £0.60 = £3,000. The percentage of the initial unrestricted market value would be £3,000/£15,000 = 20%.

When the restrictions are lifted, the taxable amount is calculated as 5,000 shares @ £5 x 80% [100 – 20] = £20,000.

Therefore the result of the election is that £23,000 in total would have been subject to income tax. Any further sale will be subject to Capital Gains Tax once sold.

The election is advantageous where the employee remains in employment and the shares increase in value between the award and vesting dates.

However, the election can also increase the tax liability where either:

- The shares are lost – forfeited.

- The shares fall in value.

As an election needs to be made within 14 days both the employer and employee are effectively making a bet on the future share price. There is no option to adopt a “let’s see what happens” approach.

Election under s.431

This treats the shares as if there were no restrictions on them when awarded. This means the income tax charge will be based on the unrestricted market value at the time of their acquisition.

An employee is awarded 5,000 shares in the company in January 2019 they work for when the share are valued at 300 pence (£3), that the employees does not need to make a payment for but if the employee leaves before the vesting date in January 2022 (are subject to forfeiture) he will lose the entitlement to these. A joint election within 14 days is made by the employer and employee under s.431 ITEPA 2003.

In January 2022 the shares were worth 500 pence (£5).

In January 2019 the unrestricted market value at the award date is 5,000 @ £3 = £15,000.

When the shares vest in January 2022 there is no further income tax charge. The share are subject to Capital Gains Tax once sold.

Although the s.431 election results in less tax in this example there are 2 potential drawbacks:

- There is a risk the shares may not have increased in value. This means the individual may have paid tax on a share price higher than when the election ceases to exist.

- There is a cashflow issue, as tax has to be paid on the award. However, the shares can only be cashed in once the shares have been sold, which is after their vesting date.

How to reduce Income Tax?

The main ways to reduce income tax on the vested shares are:

- Pay more into a pension either via an employer scheme or a personal pension scheme. However, please note you must be careful you do not go over the annual pension limit. You may have previous years unused allowances to carry forward.

- Although risky some clients may invest in EIS, SEIS, SITR or VCT schemes, which provide tax advantages. However, there is a risk that these go bust, so you would lose this investment.

- Once the shares have vested, if you were to retain these you may receive dividends. If your total dividends are in excess of £2k and you have a spouse you may wish to transfer some shares to them to make use of their £2k dividend allowance. However this reduces to £1k for the 23/24 tax year and £500 for the 24/25 tax year.

How the Capital Gains Tax works

As mentioned before, once the Restricted Share Units vest, they are subject to Capital Gains Tax. If you sell the shares on vesting there may not be any material gain or loss. This is because the disposal value should equal the vesting value, albeit there could be selling costs. If you retain the shares after vesting, any increase in valuation will give rise to Capital Gains Tax.

Where you have Capital Gains in excess of £12,300 for the 2022/23 tax year, you will have Capital Gains Tax to pay. It is proposed that this Annual Exemption will fall to £6,000 for the 23/24 tax year and £3,000 for the 24/25 tax year. Capital Gains Tax is charged at 10% for Basic Rate Taxpayers and 20% for Higher Rate Taxpayers.

How to reduce Capital Gains Tax?

The two main methods to save Capital Gains Tax:

- To make use of your ISA allowance by selling the shares into an ISA upon vesting. This will ensure that any dividends are not subject to UK taxation.

- Transferring the shares to a spouse through a no gain no loss transfer, so that they can use their Annual Exemption. The spouse may also be a Basic Rate Taxpayer, meaning they may have some of their 10% banding remaining. We have assisted clients before to help them save from £6,230 to £12,000 in Capital Gains Tax.

Assistance

This article does not cover everything you need to be aware of. If you require any further information or assistance with your Restricted Security Stock Units and how they are taxed in the UK, please contact us. A member of our team will be happy to help.